Kathy: Are we alive? All right. Well, welcome to the October session of business. As unusual talent strategies in a recessionary environment, we’re going to get started in just a few minutes, but I wanted to do it. A little housekeeping before we jump in. So if you’re attending via our live stream, Dana Kramer will be managing the. Chat, so please. Feel free to use the chat to add your questions, and she will feed them to us today. So, I am Kathy Steele. I’m the CEO of Red Caffeine. And for those of you unfamiliar with red caffeine, we are a growth consultancy, and it’s our mission to build Batas brands that people want to work for and with what is your organization’s best opportunity for growth. There are really many options, but building the right strategy to improve your business. Performance can be really daunting, so we help companies build a strategy to accelerate growth by evaluating which path is right for your business. Our offering includes A managed service team that enables a business to scale rapidly without hiring a wide range of full-time staff members to move a growth plan forward. And so today, we’re going to be tapping into one of the hottest topics many businesses are struggling with. The human capital growth lane. So welcome. So I first want to. Jump in and Introduce my co-host. If you’ve attended BAU before, you will remember Mary Lynn Fayemi. And Mary Lynn’s the president. And the CEO of HR. Source and they’re a Chicago-based employers association with over 1200 member organizations. So she’s seen and heard it all. She’s been a highly respected speaker, trainer, advisor, and authority on various workplace issues, including culture, employment trends, and HR management. She’s a prolific writer. She’s a prolific writer, coated and published regularly in a variety of industry publications, and she currently serves on the World at Work Board of Directors and is the past chair of the Board of. Directors for both. The association forum. And of Chicago land and the Employer Association of America, Mary Lynn was recently honored by Crane Chicago business as a notable leader in HR. Congratulations on that honor. That’s a big deal. And then we’re super excited to invite Tim Shum today. He is the founder and president of Lucas James Talent. Partners, and he’s our guest expert. So, in 2019. Not too long ago, Tim started Lucas James Talent Partners, offering a unique approach to the indicated antiquated recruitment industry, providing an on-demand, cost-effective, dedicated offering that saves customers 40 to 60% compared to his competitors. So it’s no wonder that in just three years. Tim has led Lucas James to over 100 internal employees, 12 million plus annualized revenue, placing over 500 people into their next career opportunity. Unity and becoming the go-to partner for the Chicago technology community to help them scale up their teams during a rapid growth period. So, welcome to both of you. So I would love to. Start, you know, by asking our guests. What’s not in? Your bio, Tim. Tell us a little bit about yourself.

Tim: Sure, you did such a great job. Nice to meet everybody. Thanks to everyone for joining Marilyn. Nice to meet you, and excited to spend a little bit of time together to talk about this topic. There’s a multiple changing landscape that’s going on right now. I’ve been in the talented recruitment space for 16 years. This is kind of all I know. You know, I saw the 2008 and 2009 cycles, the period of growth beyond the last 10 years of the boom cycle. So, especially in the last two years, we’ve seen just a bunch of different variables that have led to some growth for companies like ours that led to some challenges for companies out in the field. And I’m just excited to talk about this topic. It’s something I’m super passionate about, and I’m looking forward to jumping in.

Kathy: Yeah, I mean, I remember prepping, prepping for your session and your growth. You know, acceleration was so interesting. We probably could have done a whole hour on what you learned during those, you know, those growth years. So excited to jump into this topic today. But so a lot is going on. I’ve even just been thinking about this. End of 2021 and what we were experiencing in the talent landscape then and then now. We’re at, so why don’t we? We step back and and talk about some of those macro trends that you’re seeing we’re seeing, and Tim, have you kind of walked us through?

Tim: That, yeah, that sounds good. That sounds good. So, although I’m a leader in the talent community, we deal with recruitment and different industries. Things like that are just a personal kind of preference of mine. I just like to follow the markets. I watch CNBC videos during lunch. I watch the CNBC squat box in the morning. I read the Wall Street Journal. What’s going on in the economy is just very, very, very, very interesting. At the moment. There’s just a lot of different dynamics that are happening right now. So I talked to my team about this, and we actually. Have 170. Ladies. And we deal with a lot of different industries, and certain industries are getting hit a little bit harder, and some industries aren’t really being affected right now. So I found myself on Mondays just talking to my team about the economy. What’s going on with inflation? What’s going on with unemployment? So I thought for your audience, maybe we could kind of start at a high level from a macroeconomic standpoint. The title of this. Are talent strategies and a recessionary environment? Are we in a recessionary environment, or are we not? I think there are just a lot of questions around that, and depending on how much you follow this stuff, you may not. You may not know. And for some people, this might be a little bit redundant. So, let’s take a quick step back. So coming out of 2008, 2000. In a recession, 2010 was kind of a little bit of a rebound year, but if you take a step back and look at it, we’ve been in a 10-year bull run that has been very, very, very bubbly in a lot of different contexts, right? And if you look at the average recession, it’s about seven months or, excuse me, it’s about 11 months. On average, we hit a recession in recent history. Every seven years. So there’s a seven-year cycle of boom times, and then there’s a maybe 11-month period of downtimes and then another seven-year cycle of boom times. So the point of this slide here is to show that we’re kind of due for something right now, right? It’s been 10 years. There’s been a lot of foam in the market. We’ll kind of get it. Into some of the subsets of that but. So if you look at this chart, the 2020 recession, you might be saying, hey Tim, we just had a recession 2 years ago. And if you look at the dynamics of that recession that we went into. It kind of doesn’t count, unfortunately, when we’re looking at macroeconomic trends and liquidity in the financial markets and boom times and interest rates and things of that nature, 2020 wasn’t really affected. The 2020 recession was a pandemic. Infused senior leadership of countries shutdown, which caused a recession in economic activity, and that was very short-lived. So you could look at that and say, hey, we had a recession; we shouldn’t have one for another seven years, but unfortunately, it didn’t count, right? So, what are we due for one of these cycles? So, let’s go to some of the dynamics of the 10-year bull market. If you want to go to. The next slide, the 1st, is the advent of the private equity industry. So if you’re unfamiliar with private equity, essentially what that is, these are investment bankers that are raising private funds, rich people, endowment companies creating funds, and then they’re going out, and they’re buying a majority-minority or all out acquisitions in private. Industry, right? So this started about 25 years ago, it’s seen huge growth over the last 10 years. So what they do is they buy companies, they create efficiencies, they inject capital for growth. So, a lot of the growth that we’ve seen is a direct reflection of just this dichotomy within private equity. It causes efficiency. We’re investing capital for growth, which causes things to go up and causes some confidence in the market, and that can continue. I believe over time, but we’re kind of at that point now where we’ve seen such an injection of capital due to low-interest rates. In the private equity industry, we’re just kind of due for a little bit of a reset. If you want to go to the next slide, there’s a subset of the private equity industry that’s super interesting. So, if you’re sitting in a technology company. You’re sitting in the technology industry. You worked for a startup before; a subset of private equity is what’s called venture capital. So venture capital has also seen a huge increase over the last 10 years. These are investment dollars that are being allocated not to just every industry but specifically to technology companies. And if you look around at all the industries eco, economists will say. We might have some growth in healthcare. We might have some growth in manufacturing or consumer. Goods. When you look 10 or 20 years out, there are not a lot of industries that aren’t going to be tied to technology and new industries that are being created because of technology. This is a huge sector of our economy in the US and globally as well. Over the past 10 years, we’ve seen an increase in dollars invested in this space, an increase in hiring, and an increase in the labor market. Dynamics and again, we’re now due; we’ll get into some of the dynamics of what’s going on in the technology sector, specifically rates related to venture capital that’s causing a little bit of gyrations in the market. If you want to go to the next slide. Again, we’re just talking about some kind of macro economic trends. So this chart, if you can’t see it, it’s essentially what the Federal Reserve funds rate is. If you don’t know what the Federal Reserve Bank is, it’s essentially a central bank. It dictates two things. They have a two-step strategy. They want to keep inflation low. And they want to keep unemployment low. That’s what they set out to do. Now, what they do is they set what the interest rates are for our economy. So this dates back to 1982. So, interest rates were like 1214%. So if you heard back when, I don’t know, your parents bought their first house, mortgage rates were like. 1415%, you had to put a lot of money down on cash. To even. If you wanted to buy a house, then interest rates have continued to become lower and lower. Lower and lower. So when interest rates are low. Power banks can then borrow money at a much lower rate. They can offer money to businesses like mine and yours. They can inject that into growth, which causes hiring stuff and causes a frothy market and things like that. We’ve been dealing with a very, very, very low-interest rate environment for a very, very, very long time. And when money is cheap. And when interest rates are low, and people can buy houses at 2%, you know, mortgage rates and things like that are high as a business can borrow more money at four or five or 6%. I’m going to be more advantageous in investing that capital into growth, and we saw that all across the industry, every company, every individual saw this, and this has been going on for a very, very long time. And this is something that I’ll come back to in terms of how the Federal Reserve is affecting the economy right now and potentially causing a recession. So we’ll get it. Back to that. You want to go to the next slide. Cool. All right, characteristics of an overheated market. This could be pre-2001. This could be pre-2008 or 2009. This could be kind of like right now or at least the last couple of years, right? Low-interest rates talked about cheap money invested into riskier assets, speculative assets, and industries. So you probably heard a little bit about like Bitcoin and NFTs, and you know, hey, I’m going to invest in this startup, and it’s going to go to the moon, and it’s going to IPO, and it’s for sure going to make a lot of money or meme stocks when money. It’s cheap stuff, tends to get invested into riskier assets, and then everybody thinks that everything is going to go up and everything is going to go up forever. And we have this confidence in this boldness of the economy that quarter over quarter. We’re just going to apply the same playbook. We’re going to grow; we’re going to grow, we’re going to grow, and then, unfortunately. A recession hits, and then we have to change our playbook so we’ll get into a second low unemployment. Everybody’s got a job. Everybody that wants a job has a job, rising wages due to that, unemployment, and the labor market dynamics. If there’s a war for talent. How do you attract more people? You increase their wages to attract them to your company or have them be retained at your company inflation. Again, we’ll get into this in a second, and one very interesting thing is fraud. So every time that there’s like a booming economy, that’s kind of going on, and everybody’s excited, and the kind of no one’s looking really under the hood of what’s going on, you tend to see. Bad actors are taking advantage of certain situations in the economy, right? So, Bernie Madoff is an example of two. 1008, right. But everything was good. No one was looking under Bernie’s hood to see what was kind of going on right there, right. And then that happened. Now regulation comes in. So next cycle, things tend to move a little bit more smoothly, right? Going back to the 2001 and 2002 recession and Ron? Everything was good, right? No one was looking at what they were doing. No one was really looking at their financial statements. Fraud happened. Now, people are looking at that a lot more. We put in regulation, and the next cycle that we have is just going to be a little bit smoother. If you go to the next slide, please. The first portion of this is going to be a little bit slide-heavy. Then we’re going to get into some. Dialogue, but we. Want to kind of set. The stage. So where? Where we’re at today. 22 or 2023, are we in a recession? I think you probably know unless your head is in the sand, you probably read a headline. Are we in a recession right now, or is there going to be a recession in 2023, or you’re starting to feel it a little bit more? You might have a neighbor who got laid off that was in the tech sector or something that is kind of wild at the moment. And you might be asking yourself, OK, what is what is kind of going on. So today we’re dealing with massive inflation, OK, so inflation is due. There are a lot of different factors, but when you look at inflation, it’s basically that prices are going up, and when prices go up, there are only. Two things that can happen. Either demand is higher than supply, so companies are raising their prices due to high demand, or supply is lower at the same demand. So people that have a limited supply, they’re going to raise their prices. Right. So, unfortunately, at the moment, especially in the last two years, both dynamics are happening. Right. We’ve had a lot of demand. We inject a lot of money into the ecosystem. We inject a lot of government money. We had a low-interest rate, so people were borrowing a lot of capital, which increased demand. We were at our houses in the pandemic. So once we kind of. Like got out. In the community a little bit more, we’re spending a little bit more. The demand is really high and unfortunately. Due to COVID, our supply chain issues across the globe and specifically in this country are very dramatic, right? So when China shut down, when did Europe? Shut down when we have the Ukraine-Russia issue and that we’re kind of cutting off oil supply that used to come from Russia. There’s this global dynamic that’s happening where a product that has 10 widgets and widget A comes from China, and they have to go to Europe to be assembled. Then they kind of go across the seas to the US and then eventually kind of get after a train. Or a truck gets into the retail store. It’s slowing down that dynamic, right? So, we have supply chain issues across most industries that are increasing price pricing as a result, and we’ll get into the labor market dynamics here, where the labor market is tight, and companies cannot get talent. What do they have to do? They have to raise wages, they have to raise prices and when you raise a big input like wages. Your profits are going to be lower, so you’re probably going to raise prices to offset that and pass that on to the consumer and pass it on. To the business. That you’re providing goods or services to the Federal Reserve is going to be raising interest rates they already have. They’ve raised it from 0% to 3% onwards to 5% plus at the moment. So what they’re looking to do here, which is very unfortunate. For all of us, they’re trying to cool the economy. They’re trying to get that demand side. Down. So pricing goes down, and they have to cool inflation. We cannot have inflation increase 8% year over year over year over year over year. This is affecting this is going to affect if it hasn’t already all of us and we’ve already seen this in the grocery store. We’ve seen it. If we wanted to go on a vacation, we’ve seen it in every. Area of the economy at the gas. At the gas station, we’ve seen this in every area of the economy. Eventually, something is going to crack where people are going to start making business and personal decisions of, hey, things are costing more. I’m going to start to spend less, right? And when that happens across the entire globe, there are a lot of problems there. So, we have to get inflation down, and how do we? That we raise interest rates to cool demand. So, unfortunately, the only thing they can do is raise interest rates, and unfortunately, what that does is it’s going to cool demand, it’s going to slow the economy down. And that’s why when. We’re trying to. Predict what the next 6-9 or twelve months is. We know that they’re raising interest rates, which is causing this uncertain environment that we’re about to head into, and we just don’t know if it’s going to be severe or mild. We also have global instability. I’ll hit on this real quick. Everybody’s probably watched what’s going on in Ukraine and Russia that can’t, can’t end soon enough. If you look over in Europe, some of the dynamics that we’re dealing with in the US are probably two or three X over there. They’re going through a recession right now, and their inflation is almost double what we have here in the US, so all the issues are that. We’re dealing with, they’re dealing with. To a multiple degree, and eventually, that’s, you know, going to kick around the globe and eventually kick around to us. Want to move to the next slide? Hopefully, this isn’t boring people. Hopefully, this isn’t too redundant, so next, we’re going to look at the labor market dynamic. There are some I geek out on this stuff. Some very interesting longer-term effects on the labor market are going to impact all of us, whether we’re employees somewhere or we’re business leaders. We’re an HR and. The interesting thing about what’s going on now is Kathy; we were talking about this before we went live that the economy is slowing down. We’ve had two quarters of decreased GDP. I would imagine Q3 is going to be down as well. I would imagine Q4. Is going. To be down as well, but. Unemployment is going down. With all that. Happening. We still have labor market tightness, right? you might be asking yourself why or if it is part of a longer-term trend. So the first slide here and the first variable of this is the baby boomer generation is starting to get to retirement age, right? So, if you can’t read what this chart says, essentially, it’s the percentage of the overall. Population that’s retiring year over year, you kind of start to see this go up and the overall population is very much tied to the baby boomer population because they’re the ones retiring, right? So, the purple line and the orange line, the baby boomer population started retirement in 2000. Over the last 10 years, they’ve started to retire and leave the workforce, right, and it’s getting to the point where that entire generation is starting to retire in droves, right? The baby boomer population, I think, I don’t know. We probably have some folks on this call. We probably have some parents that are in the baby boomer generation. Essentially, if you know what the baby boomer generation is, they just had a lot of kids. Back then, I knew my dad was one of seven. My mom was one of eight. Like, that was normal. I got a tonne of cousins, like I have two kids, and I’m done, right? And I think. That dynamic. Has kind of changed over time, right? So the first is we are losing our largest population of the workforce right now. They’re at the peak of their experience level. They have the most knowledge. They are potentially managers or leaders, right? And they’re exiting the workforce and now we have other generations that have less population trying to offset that. Now the interesting thing I’m going to talk about in the next slide. If you see that purple line over the last two years, there’s been a disconnect. We’ve had other folks outside of the baby boomer population retiring. They’re leaving. Workforce like you only leave the workforce when you retire, right? Like we kind of get in our heads. That should be at like 62 or. 65, and you’re on Social Security. We have a major effect that’s happening right now in the labor market where not only is the baby boomer population the largest population that we have, but we also have others that are leaving as well. So I’m going to get into one variable of the reason for that. If you want to go to the next slide. So again, this is the generational wealth gap chart. It’s a busy slide without having to read everything. Essentially, what it says is the baby boomer generation has 53% of all the net worth in the entire country, right? So folks in their late fifties, 60s, and 70s have pretty much. The majority of the wealth is in the country. So what happens when they retire and slow down? What happens when they, unfortunately, pass on a right that gets transferred, that gets transferred initially to their spouse or their? Looking, and then eventually, that gets passed on to their children. Correct? Right. So we have this very, very interesting dynamic, and I think this stat is somewhere between $30 and $70 trillion over the next 8 to 10 years that is going to be transferred from this generation to their kids in their thirties, 40s, and 50s. So anecdotally. I’m unfortunately going to benefit from this, which sucks, but you know, some of you may teach on your own, and this is what I’d like to pass on to my kids. Right. I think that’s a dynamic that we all kind of think about. But if you had it in your head that you were going to retire at 60, and then your mom and dad gave you 1,000,000 bucks, and then your spouse’s mom and dad. Gave you another million bucks. That’s going to change the retirement calculator, especially if you go through the pandemic. Where everybody’s mortality is coming kind. Of top of mind. How you want to live your life, being cooped up at your house, right? We have a lot of people who are exiting the workforce right now due to this, and that is going to continue at least over the next 8 to 10 years. That’s going to keep them. The labor market is tight. There are way more points around this. I’m going to hit on one more. If you want to go to the next slide. I’m going to hit on a few more. Actually, the next is the immigration dynamics in our country. If you want a growing, booming economy, you need workers. You need workers to produce the product; you need workers to write the code for all the software that gets kind of put out into the economy; a major variable of this that’s happened over the last 30 years is our immigration policies. We’ve had people entering the workforce at all the levels of the economy, so we’ve had the hourly folks that are kind of coming in and. Staffing our stores, the distribution centers or restaurants, we’ve had the skilled kind of trade folks kind of come in and all the way up to knowledge workers folks coming in from universities from countries all across the globe into the United States and adding to our workforce here as you can see. From this chart. Due to policies over the last. What would be 6 years? This is going down dramatically, and the trend is continuing. That is going down dramatically. So we have all these labor market dynamics that are kind of happening. We have baby boomers retiring. We have other folks who aren’t baby boomers who are exiting the workforce right now, and then a huge percentage of our inbound year-over-year workforce. It is continuing to decline. Right. So right now, yeah, there might be an economic issue or things like that. Unemployment is still low. Weird. So this is going to last forever when this rebounds; if you’re a business leader, you’re an HR. You need to be ready for this, right? Because of the playbooks that you were used to in the past, it’s just going to continue to get tighter and tighter and tighter. And you’re going to be competing against everybody else. There are four more points I want to head on. If you want to move to the next slide. In terms of the labor market dynamic. All right. So the first is remote working. This is a super interesting concept to me. The labor market is just like any other market. It’s due to factors based on supply and demand, right? So right before the pandemic, pretty much up until March of 2020, most organizations had on-site workforces, right? So, as an hour leader or business leader, you need to. To find. Workers to work for your company within your company. History Your Canada pool was a finite amount of people within a 20 to 30-mile radius of your work site. Location. On the flip side of your work in the ABC industry, you probably only had a. Handful of companies. That was in your industry that probably made a lot of sense for you to work for. We see this in a lot of industries where there are. There are only 5 competitors. In the ChicagoLand metropolitan area, they just kind of, like, steal each other’s people all the time and that dynamic. Has always been very prevalent. You only had a finite amount of companies that you could work for within a 20 to 30-mile radius of your home location, so that all got flipped upside down, right? So pretty much overnight, if you’re a candidate and you had 10 to 20 opportunities that you could find. That’s now 100 X, right? The world is your oyster. You can work from home, but now these companies are interested in picking you up. If you live in Missouri and your employer happens to be in New York, it doesn’t matter anymore. Same thing for employers, right? Your Canada pool is going to increase; I think, one thing in terms of the micro labor market dynamics here. You know, many of us have worked from-home policies great. Many of us have hybrid policies. That’s great, too. But if it’s hybrid, you still need to be kind of in some sort of commutable distance. The work site location, or do you need to be on-site? I think the point here is just to know that this is jamming up the labor market indefinitely for the foreseeable future because I don’t think this is going to go away; it might not be 100%. Like it was in March of 2020, but depending on what your company is doing in terms of on site versus hybrid, just know that your Micro Canada pool for your opportunities might be lower depending on the. Policies that you. The next is the gig economy. So when we talk about people exiting the workforce, there’s this new way of working now. Where people are exiting full-time employment, but they’re picking up other opportunities, either for a bunch of different gigs that are now their full-time employment or they’re only partially in the workforce altogether. They’re just not W2 employees that are being counted anymore. So our Uber drivers are DoorDash drivers, right? Freelancers companies like Upwork. There are just so many different platforms and the boom of the Internet. You can go work from home on projects part-time when you want, how you want. That there are just not as many W2 candidates that are out there as much anymore, right? And this is a trend that’s going to. Continue, and we just need to adapt. The next is the skilled trade. The skilled trades, I should say so. If you’re a manufacturing company, you need to hire a plumber. You need to hire an electrician back to the baby boomer generation. This is kind of like the last generation, where there was an influx of people joining the trades compared to other industries. And now, as these individuals retire, that labor market is going to be. On the micro level, extremely tight. So, if you have these skill sets within your company, you have to kind of work around that. Accordingly, and the last. The thing that I’ll mention is wages. We could talk about wages. For an hour. What I will say is it’s not as variable as you might think as other supply and demand dynamics. So you might think, oh, there’s a recession, or the unemployment number is going to go up. So there’s going to be people that are more likely to take less pay. They may be in the short term but in the long term. There’s a huge floor in terms of salaries and wages for folks. It never really goes backward, right? So wherever we’re. Today, if that had to increase over the last two years, we’re at this new normal. We need to operate our companies at this new normal because it’s, it’s. Not going to go. Away, right? You might be able to pick up a couple. Employees here are there at lower wages than you are now, but they’re probably going to leave on you because the company down the street isn’t adopting that policy. All right, next slide. I’ll just finish real quick on this current state. The stock market hit a high in January 2020 or 2022. If you have a 401K, you probably know this. You’re just down; you’re just down 20% probably overall if you’re in the Dow if you have any tech companies, those are down 50 to 70%. The market is typically a predictive indicator of what’s going to happen in the general economy. So I think we need to kind of follow that a little bit and kind of brace ourselves for. Maybe strategies around this, which we’ll talk about more. There’s a deep recession in the tech sector. They’re talking about this being 2.0 in the tech sector, so we could get into this if you’d like, but essentially, all the high-flying and the venture capital industry over the last 10 years. It just kind of came. To roost, unfortunately, we realize these companies aren’t profitable. If they do IPO, they’re probably not going to be valued what they thought they would be because the NASDAQ, unfortunately, is down 50 to 70%, and that trickles down from Series D, series C, and Series B seed companies. Right now, their ability to raise capital is limited. They just can’t right now. So, these companies are basically funded to continue to grow because they can’t fund themselves. So there’s a deep recession in that sector, although there might not be other recessions in other industries, supply chain issues, we talked about inflation, unemployment, what is the Federal Reserve? Going to do that. We’re in an uncertain environment, so I’ll kind of end there. If you want to pull the slides down and Kathy, I’ll pass them over to you if you have any questions on what I presented or any other areas you want to talk about.

Mary: Go ahead, Kathy.

Kathy: No, I said. I’m going to let you. You take the 1st Stab.

Mary: sounds good. Good. Oh, my gosh, Tim, you make economics fun, but not. The thing to do, so I have so many questions. First of all, talk a little bit more about this term. Frothy, like I like my cappuccino. Frothy, but talk to us a little bit about it. Frothy means, and then I’ll delve into it. Little bit more. Into. Does that mean employers should be hiring or tightening their belts in response to what’s happening in the economy?

Tim: Well, I think. Well, the term frothy, I’ll just kind of get to that; it could be used for frappuccinos. It could be frothy or. Anything could be frothy, and I think other adjectives to describe frothy are overextended. Confidence in growth. I think so, The economy is a direct reflection of psychology and how people think, right? And I think we’re seeing, and now I’ll get to your question on what people should do, but when things are good, like you just get into this mindset and as individuals, as companies that we can do no wrong, right? You invest, and it goes up, right, or you make a business move. And then the revenue goes up; you just get in this positive psychology and this great positive mindset, which is great. But when everybody’s in that positive mindset. And when you look under the hood, there might be external factors that are making those individual decisions frothy. That might not actually be frothy. It’s going to come to roost at some point, right? So, I think we’ve now pivoted. So, if you look at the CEO confidence report, it’s declined quite a bit, like CEOs are not very confident right now. CFOs are not very confident right now. It’s also psychology on the other end, right? Because when you look at some of the data. Unemployment is low, and people are still spending money; most industries aren’t affected, yet tech got out of whack, but most industries aren’t affected. The psychology of like, Oh my gosh, is there going to be a recession? Should I tighten my plan to hire a lot? I’m scared because everybody else is scared. So, I’m going to slow down hiring. It’s almost like when that happens across. A community, an economy, or a country as large as ours that’s going to trickle into the business decisions that that’s going to trickle into the psychology of buying things at the individual level. And you know, eventually, things are going to slow down, right? So I. I think when we talk about an uncertain environment, you have to look at your situation and go. All right, compared to others, am I in a capital positive position where not only can I sustain, but can I invest in what I’m doing right now? Or should I be more conservative in how I’m going about my day-to-day again, either as an individual or a business leader? And just get through to the other side and justice, make sure I can get through to the other side. So I think it kind of depends on the individual’s situation in the company based on the industry that they’re in.

Mary: Yeah, I think. That’s really important feedback, Tim, that it might be location-specific and industry-specific, but you can’t just make a general. You know, broad. Brush decisions about what hiring looks like for your organization. And until you really determine what the factors are right, you could have some great opportunities to hire talent right now. If you’re still in a growth mode, right? Which could be the case.

Tim: Yeah, I think how? I would be looking at this. Is, you know normally when. Everybody else is in dark times in the dark mindset. They’re tightening their belts; they’re not spending money. Normally, you could say, Right, I’m going to do this. I’m going to invest in the future, right? And I think that is really, really, really good advice because these things don’t last forever, you know, like I’ve run a recruiting business. I cannot believe that I’m dealing with this again. I just, it wasn’t 20/20/19, it was 2018. When I started, but I have. Two major economic situations that are happening in four years, I like, are. You kidding me, you know? But I’ve been to these cycles before, right? Like whatever time goes by, as I go home, I go hang out with my kids and my wife, and like later and repeat.

Then you pick your head. Up again and then things kind of rebound, right? Then you’re always kicking yourself for not making those investments or having confidence in that rebound, right? So I think if you’re in a capital-positive position, you’re continuing to grow right now. I think that was a really, really good time to invest more in talent acquisition and maybe top-grade your talent or just make sure that you’re retaining your current leaders. Like you don’t want to go backwards and play whack a mole on the other side with retention issues, right? So I’d say yes, but I would say the general vibe right now as people are trying to figure out what their playbook should be in an uncertain environment for sure.

Mary: Yeah. I think that last piece. Of guidance I was. And put an exclamation point behind, and that is. Make sure even if you. Tighten your belt with regard to hiring so that you’re sending the right messages to your team about retention so they don’t start looking elsewhere because they. Believe that. They’re reading something in. To the health of your organization by the fact that you’re not.

Tim: Hiring is one thing you can think about on your last point there, so you know we had a great resignation, you know, and I did things like this and what’s the great resignation and what do you do and all this kind of stuff when things are really, really frothy. And there’s just so much hiring going on and open jobs, it became a candidate. Market, right? So it was like unprecedented times where? Didn’t matter what occupation you were in or where you sat kind of in the economy or location for that matter. Now, right? It didn’t matter if you were in a rural town with five total businesses. You could find another job. I can go with you. Can find something. People were quitting their jobs, taking some time off, and kind of going, you know, going on to the next thing because there was confidence. And the ability to do that? I don’t know. I don’t. I don’t know if you. Should be doing that, right? Hey, things are going great at work. I don’t know. Maybe if this was 18 months ago, you could just put your notice in and then just go on the job market and you find your next opportunity, probably better, probably more opportunity, more money, probably better, better benefits. That’s just not the case right now, so. I think you’re going to start to see, and leaders should watch this in your current workforce. Maybe I want to leave or quit. Quit right, but not have the opportunities to go on to the next and we have to be evaluating that. How? How do we make sure that everyone feels safe? You know, if we’re in a position where we can make our employees feel safe and they’re not, there’s not going to be layoffs, and we need to be overemphasizing this; we need to be investing in our culture, right? Because I think there’s going to be a time on the flip side, and we saw. This is 20. 21 were those same employees. Maybe I didn’t have those opportunities. It changes quickly, they will, and then they’re going to bounce on you essentially. So invest that time and energy into your culture now because when you’re confident that you’re going to grow, you don’t want to be filling 20% of the seats because you had a bunch of people quit on you; fill those and then try to grow. It’s just a much harder strategy.

Kathy: So Tim, talk a little bit about salaries, I feel. Like it’s been. A Russian roulette game of, you know, in terms of salaries in the last year and even just trusting salary data and feeling like you’ve got, you know, adequate information to set pay bands and set expectations around planning for. Salaries. So what do you think? What are you seeing now? What do you think? We should plan for 2023.

Tim: I think it was a really hot topic. 2021. This year, because of the great resignation, we’re again, we’re losing people that we don’t want to lose, and they’re going elsewhere. There was a dynamic where some companies that were able to do so just kind of jacked up this salary market, right? So, let’s just talk about the tech. Sector, that’s where. We play a lot if you’re a startup in Chicago and you’re competing against Microsoft, Google, and Facebook. They are paying their software engineers 140,000, and you’re normally paying 90,000. And how they have access to the talent that’s sitting in. Backyard because of remote working that they didn’t have access to before, it causes a huge generation in the market, right? And at a time when everything was fraught, that Maryland and everything was good, and there was a lot of confidence, right? So I think now it’s starting to shift a little bit more, and I think we’re more likely to go into a period of. Higher unemployment. I think we’re going into a period of, like, not only your neighbor that’s in the tech sector is going to lose their job, but probably other industries as well. And I think that’s going to. Change the psychology again. This is all psychology, and people are not going to demand a much higher salary. Now. That being said, there’s there’s a couple of other factors. Inflation’s really high. If you’re a business leader, you have employees whenever you live, go to the grocery store, or fill up the gas tank. It’s just a lot higher. So, what are you doing in that context? I think you should kind of start there, make sure that the current team members. We are in a good spot. Getting kind of paid accordingly and increases accordingly. I think that’s a responsible kind of baseline. And then you can start to look at it. OK, how are you? I track talent, or if I’m having issues with companies leaving based on my salary bands, then I need to rethink and. kind of Look at those. I think the salary was. It’s just a huge, much larger variable over the last year or two because of the candidate-driven marketplace. I think under. Normal circumstances. There’s salary, there’s culture, there’s the fit, there’s the manager. I think everything was just, I could make, you know, 20% more like I’m going to go. I’m going to go do that. I think that was the psychology that was driven by the market.

Mary: So you spoke to this a little bit ago already? Let’s just delve a little bit deeper into I think I almost heard you say the great resignation is over or you know, almost over or? In the past or in the rearview mirror, which I think would be a welcome message to employers, but then this trend of quiet quitting and now quiet firing, I would love to hear additional thoughts on that. If you think that’s also going. Maybe kind of wrapping up or moving on to the next chapter if we’re already there. Would love to get your input on that because you seem to be having a really effective crystal ball or tea leaves that are working pretty well. So what do you think?

Tim: Those topics, well, I think it’s interesting. I mean, you, we probably have folks out in the audience right now, we’re. Like, what are you talking about? The labor market is still tight, like in my company. In my industry. And I still can’t find people like unemployment is. Still low, right? I think we’re seeing trends that will dictate we’re trying to predict future behaviors and how we should kind of adopt different strategies. But I mean, yeah, the labor market is still really tight. We are seeing a decrease in people leaving their current employer, though. So when we talk about the great resignation, everybody’s leaving everyone’s. You know, the quiet quitting that they did in 2020 when they didn’t really have any other opportunities to find another job, and now everyone’s going to do it all at once. I think that kind of frenzy is starting to subside quite a bit. But that said, back to my earlier slides, the labor market is going to be tight. The foreseeable future, right? And I think companies in general need to invest more in things like retention strategies and culture to make sure that there’s not quite a quitting kind of going on and people are excited to come kind of to work and maybe get some referrals and bring some of their, you know, friends and family into that organization. But it’s going to be tight, and you need to invest in talent acquisition to make sure that you’re winning that. Work for talent. And I just think it’s going to be a lot tighter than people realize, even if we have a short-term recessionary blip where, on a micro level, it’s going to go backward a little bit.

Mary: I think that’s so important. To for employers to know, because I think there is maybe. False sense of. This period is. It is going to be over, and then all. Suddenly it’s going to be an employer’s market again. We’re going to have lots of talent at our doorstep and, as you point out, so adeptly with all the economic indicators. Not going to. Doubtful. Really doubtful.

Tim: I think it isn’t very certain. I don’t. Think we’ll see. If things get really bad, I don’t think we’re going to see 678 percent unemployment. I just. I just don’t like there are way too many people exiting the workforce right now, and our economy is just so large that I just think we have to get used to that and some of the strategies to make sure that we’re attracting the talent and you know, going back to the point like. What to do right now if you’re a business leader or HR? If you’re a leader, feeling uncertain and fearful, that’s going to do the trick. It’s going to trickle down. Your peers are going to. See that, right? And I think the time for true leadership and that kind of like wartime CEO or wartime HR leader or wartime CFO kind of putting that hat on; I think the transparency around what’s going on in the business A is going to be very, very important, because if there’s uncertainty at the. The C level or the director or VP level? There’s definitely going to be uncertainty out in the field, and they just want to know what they don’t want. To be left in the. Dark about what’s kind of going on, but I think more. More than ever, leadership needs to be locking arms right now. Coming up with a strategy, whatever it is, based on the individual company and the individual industry that you’re in and your financial situation, but you need to be locking arms, and people need to see that and they need to see that you’re in it, you’re going to get to the other side, you’re going to get through this or you have a plan to get through it, right? And that will trickle down to. Everybody else, and I think there’s a lot of respect that comes with it. Trust and transparency, I think, get lost, and in a period where there’s uncertainty and fear and scarcity, I think it’s like the easiest thing to do is just not to say anything or internalize some feelings as a leader, and I think that’s the opposite of what you should be.

Kathy: Absolutely. And so it’s kind of to your point; I think I’m curious about, like, the. The difference in the labor market, so you know, as you pointed out in some. Of your earlier slides, there is a steady. The decline in available talent is that in certain sectors are you seeing? A difference in maybe hourly employees versus salary employees. What can we, you know what kind of information? Do you think? We should be looking at it from those standpoints.

Tim: There’s a huge labor shortage of hourly workers in the services sector. In manufacturing and distribution, so if you know me, I was in the staffing industry before starting my talent consulting business, right and the workforce of the world, the Aerotech of the world, the, the, the true staffing companies that are dealing with employees at that level. You can’t find the talent. They’re exiting the workforce. Right? So in 2020, when these companies said Sia. You know, we’re shut down. See you, right? What did they do? Do they find other gig economy opportunities, or do they go to school, or do they find opportunities to work from home? So it’s really, really, really tough out there, and it’s causing major supply chain issues because they don’t have the workers kind of at that level for sure. And I think that’s going to continue. And I think there’s unfortunately no end to this site and that. That’s a major reason why we’re having inflation, right? You know, it is because there are supply chain issues at the folks that used to make 12 bucks an hour; they’re now making 1415161718 times thousands of people and millions of people across the country. And it’s making the prices of everything. It kind of goes up. You know, if you’re in the technology sector, I think you know we had this conversation a year ago. Hey, I can’t find any software engineers. I have to pay double for the software engineers, right? In that sector, I think it’s subsiding a little bit where there’s a little bit more available talent, right? I think that’s the only true sector that’s going through a deep depression. There is a deeper recession right now, and the labor market dynamics are coming from that. They are following, you know, historically what we’ve seen before, which is like, hey, there’s more available talent. So, the supply and demand. The Annex of that Labour force is just going to be a little. A bit more open, right? I do. I do feel like this is going to hit other industries like I think it’s going. To get a little bit. Tougher before it gets better, but I’ll continue to head on. It doesn’t last forever, right? So whatever strategy that you have as a leader. I think you have to. Have the end in mind and not think so short term like last. Year you shouldn’t be like. You know, changing. All your wages are crazy because then. You know what? If a recession hits, your cost of wage is way too high. You know, for your business to operate. And right now, you shouldn’t be making shorter-term decisions. You should be thinking about the other side, but that depends on the industry, and you’re going to see some labor shortages. More available labor depending.

Kathy: I’m just coming off a manufacturing conference that I got back from last night, and when I did attend one of the CEO fishbowls, everyone’s number one priority issue was talent. So I, I completely agree that’s what we’re seeing in that. You know, in that workforce that it’s just there’s just not these available candidates they’ve been really. You know, pressure to think a lot differently about their flexibility and you know, and maybe they’re not going you, know, looking at alternate I I. Think they’ve always. There Was a place for contract labor, but they’re thinking about it, you know, in more places than they, you know, traditionally employed contract labor.

Mary: Yeah, a little anecdotal. Note yesterday I was facilitating an A round table and everyone. They were sharing their talent woes, and a number of our member organizations had raised their early rates to $18.00 an hour for entry-level. Unskilled labor doesn’t really like the term unskilled anymore, but you know that’s the job positions they’re opening, getting very, very. New candidates. And so really looking. Creative ideas. We were brainstorming, and then we had other organizations in the roundtable who were starting to consider some reductions in force. And it’s an interesting environment we’re in right now where, as you mentioned, it’s industry-specific, it’s organization-specific. One of my questions is. Are you seeing any tech? That is providing an organization with a competitive edge. Entry levels. Starting salaries mean gone are the days when people are industry loyal. Right. If people are only concerned about their base pay, they can go. Any variety of industries and look for. A dollar or two more, but anything you’re seeing with regard to. How to perhaps get a competitive edge? Or your organization specifically. For your industry.

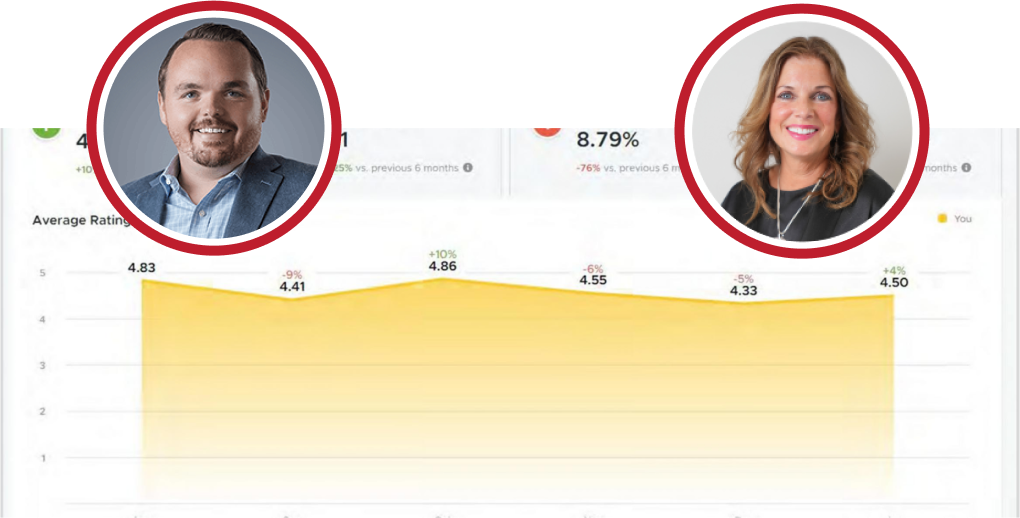

Tim: Sure, I think. Salary is always like a starting point for folks, but I think the reality is that it’s more than that. That for people they want to go to an exciting place. They’re going to be treated with. Owned and earned. Respect over time is treated like an adult, right? Receive positive reinforcement for times that they do something well and right, and I think I think that gets lost during boom times, bus times, and things like that. So yeah, there might be some I’ve seen. I’ve seen everything, you know, huge sign-on bonuses or sign-on bonuses at the 90 days in 180-day mark just to make sure that people are getting. Retained or just the? This is a whole other topic, like the HR kind of benefits landscape. Like, I don’t know if one particular benefit moves the needle and pushes someone from not accepting a job to accepting a job, but. It helps, right? I think of myself. The main point in answering your question is. With the advent. Of the Internet. Consumers, before we buy products or services. We go research online about the product and maybe reviews and summaries and comparative kinds of stuff based on other products. It’s the same thing in talent acquisition. It’s the same thing that’s going on, right? And I think companies miss this a lot when they’re trying to, you know you can. Up a candidate pool all day, but are they going to get excited and accept your job? I think that’s a different question. It’s not all about it. Salary. So we did. Survey, and we looked at some data based on our customers, Glassdoor reviews. So, like I said, just like consumers, if a recruiter reaches out to a candidate, they don’t respond to that email right away. What do they do? They Google the company. They see what videos are out there, they see what the Glassdoor views are saying, right, like you have to know this. You have to, like, invest in your talent brand, and you have to invest in your people. That will show up in these review sites. And I think that’s often that’s often missed. So, we found this data point. We found that it takes three times longer. We have to talk three times more. Evidence for a company that has poor Glassdoor views under a 3.5 out of five than a company that’s above 4.0. You just got to talk to more people. It takes a lot longer, right? You’re just kind of hoping. That they don’t. See that, and the reason that those Glassdoor reviews aren’t that good is because you’re not. Treating the people well. Right. So you got to go down to the root problem. Like all this stuff becomes easier, and then it doesn’t become like a salary thing as much anymore, like a silver bullet, Maryland. Yeah, I don’t have an answer for you. I just have to pay more. You have to do this, I think it’s a holistic approach in how you lead your people, and they’ll just work themselves out over time.

Mary: I couldn’t agree more.

Kathy: Same did we get one question about it? Salary, like posting salaries, do you believe that that is something that, as you’re recruiting, should you be posting the salary range that you’re looking for?

Tim: That’s a whole can of worms, Marilyn. You probably know that’s just being the HR space. So, like, there are certain states now, and we operate in. We have 170 team members. We have team members in 30 States, and we have clients in 25 states. There are certain states where you have to post a salary range for the job like it’s a requirement now, and you have to, you have to kind of work around that historically if you haven’t been in a recruiting department before. You don’t. You don’t want to OfferUp the salary or kind of give a range because your CFO and your hiring managers don’t want you to because they’re working within budgets, right? So it’s like you’re not trying to. Screw anybody over. By like having a negotiation around this, right? So that’s kind of the one set of the coin. The second set of the coin. It is like the Canada pool, especially in the tight market. Suppose you don’t have the. Salary there, and it’s not in alignment. They’re either not going to respond at all because they don’t have it, and if you put it out there, there’s. Probably a benefit to like. Hey, if the salary is not interesting to you and they don’t respond, it’s all good, or if they do respond, I’m not interested. On the salary. Like all good, right? But when you put it there, they’re like, yes, that’s in line with what I’m looking for. You almost get there a little bit quicker so when you’re putting it in. Job postings. It’s that same dynamic, right? If you put the salary in there. You should only get people as long as they read that portion. You should only get candidates that are kind of within that. They know that. From the get-go, but then. It goes into, hey, should you have a larger range of the salary where you have kind of more wiggle room, but then what do people think in terms of salary when they see $68,000? Where does their mind go? Where should they be? What do you want to talk about? 65 Right, it’s it’s. I don’t have a perfect answer to that, but I think I would. I would be looking at the supply and demand dynamics of the job that you’re looking for. If you have more candidates for that particular job, post the salary. Just get there quicker, and if you don’t, it’s going to be more of a strategic search. I wouldn’t. Post the salary because you might have to have a conversation with your hiring. Manager around and. It’s inside the labor market, I said. I know you wanted a senior person at this, but would you take a junior person and maybe build them up or do you have a team lead that can coach and train this? It’s not all about it. Here’s a square peg, you know. Here’s a round hole to make the match sometimes, especially in the type market. You have to have discussions like that and think outside the box in terms of just telling as a whole.

Kathy: Oh my gosh. Well, I can’t believe you’ve only got a. Few minutes left. But I am going to sort of ask our final question. It is leaders planning for 2023. What do you know? What would you say is the one thing that you should be thinking about in terms of your talent strategy for next year?

Tim: I think if you’re if you’re not. Stable financial. I would be investing through this because it’s not going to last forever, and I think the companies that are being proactive, getting proactive candidate pools, top grading their talent, making sure they’re keeping their current people, they always thrive on the other side of these things, the companies that are investing are going to thrive on the other side. It’s just hard when the psychology around you is. Fear and scarcity and this. You know, this could happen and stuff like that. But if you’re confident in your business and your financial position based in the industry that you’re not would be investing if. You’re not so. If you’re not as confident, I would be making budgetary forecasts around the best-case, worst-case, and medium-case scenarios, and I would be checking those on a monthly basis. And I would be leaning into my culture, right, because whatever you think the worst-case scenario is, it’s typically not going to be that bad. And again, it doesn’t last forever. So lock arms, lead your leadership, get through to the other side, sit in your people, and just make sure. Or if you’re worried about your finances, you’re putting your best foot 1st and optimizing the opposite side of this thing because it’s not going to last forever, even though it might be a little bit tougher. Well.

Kathy: Excellent advice. It’s very interesting. We were just having this topic in our leadership team conversation right before this. So I feel a lot better about the decision we ended up with. So thank you so much, Tim. So we want to give people an opportunity. Parker, could you put up the time’s contact information? You’ve got more questions, and I’m sure you do. Tim graciously agreed to answer. Your questions, you can reach out to. Him on LinkedIn. Or via his email address and just put business as unusual in the subject line so he knows that you’re. Coming from our session today, thank you so much, Tim. This is. Just, I mean as we. Told you it was going. To go fast, and it certainly did. We’re down to just a few minutes left. We want to also, you know, say thank you to our sponsors. So we’ve got Insperity, and Insperity is a PEO professional employer organization since 1986; they’ve been showing companies how to. Harness the power of. HR to improve their business success. M3 Learning and one of the. Been one of the most influential and successful sales, training, and sales management training companies worldwide and then. Of course, our friends at HR Source and they’re an association for employers, and they really help you manage your HR. It needs to be efficient and economical and then stay in legal compliance and maintain time points. A happy, healthy employee population. So that’s going. We will definitely be leaning into our friends at HR source as we get into the. Next year, so. Want to give you guys heads? Up as to what’s coming in November, so we are. Going to be bringing our subject matter experts on these really critical. Topics back so. So, Tom Waterbury and Mary Lynn will be back, and Joe Gary will be joining us to talk about what things you’d be considering for your 2023 trends. So, what we’re going to be talking about is sales, marketing, talent, and technology. And so you know, we’ll be digging into what trends are just trendy. And what things should be the most in your 2023 plan? So please join us on November 17th. For this, really. Interesting panel discussion about preparing for next year. And then just thank, thank you to everyone for joining us today. We really appreciate your attendance and your support for our business as unusual. And thank you again to Mary Lynn and Tim for being a part of today’s session.

Mary: Thanks, Kathy.

Tim: Thanks, everybody.

Kathy: Thank you.