It’s hard not to get excited about something new – a fresh start, a birth, a new year. 2020 is over, so how can we take the lessons we learned and use them to our advantage this year?

Our first webinar, The Impact of 2021 Market Predictions on Your Business, focused on the significant disruption of last year and how it would affect our approach to business growth plans, succession strategies, and investment portfolios. My guests were Chief Investment Strategist at Fifth Third Bank, Jeff Korzenik, Steven Ryan, Director at Prairie Capital Advisors, and Michael Rarey, CFA and Principal at Capital Strategies Investment Group.

Following are my thought from the insights shared by this incredible group of thought leaders.

How Does the Market Outlook Impact Our Growth Strategies?

While our overall US economy suffered in 2020, some business sectors were untouched, while others saw tremendous growth. The key is to recognize which sectors have long-term potential post-pandemic conditions. This slide from Prairie Capital shows how the Private Equity Market has looked at valuations across markets based on the impact of COVID.

Safe plays align your market strategy and sales focus to the industries that saw little or no effect from the Pandemic. But there are sectors deeply impacted that will see an immediate uptick due to pent up demand. Could your product or service help them ramp up? I believe investing more boldly in sales and marketing activities in this first half of the year, while your competition may be playing a wait and see approach, will pay off as the economy start’s to open up mid-year.

Will American Businesses Need to

Retool Their Approach to Growth?

In 2020, we saw how vulnerable our US supply chain was. Businesses were forced to digitally transform their workplaces overnight. Unemployment rates increase to record highs from 2019’s record lows, but specific sectors still could not hire right-fit talent. To capitalize on reshoring opportunities and combat declining birth rate trends in the US, we will have to continue to embrace change and fast!

Our talent and hiring strategies are antiquated and do not take advantage of diverse and underserved communities. Zoom, remote work, and increasing reliance on automation are here to stay. I believe every business should have a digital transformation roadmap and review their talent strategy as a top priority in 2021.

It is Time to Reimage Capitalism

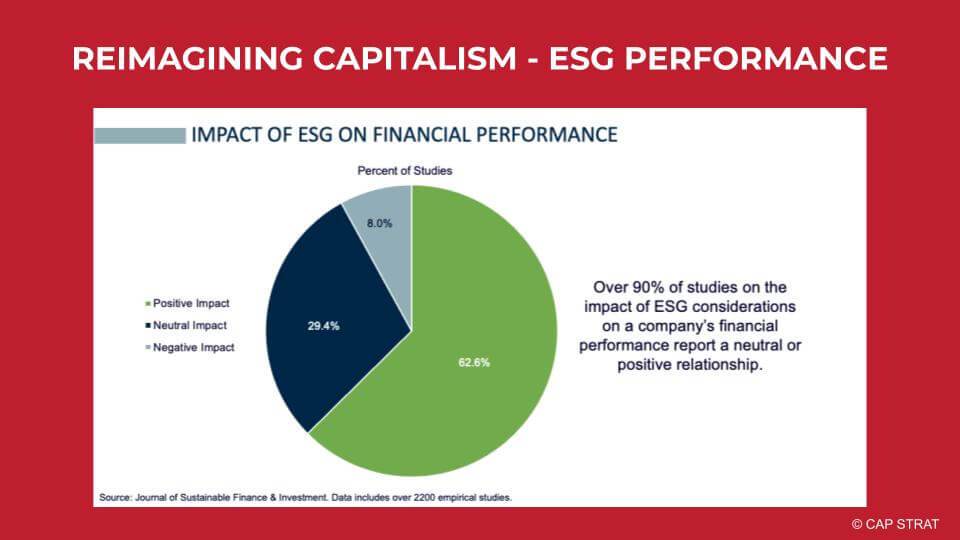

As we move through 2021, will companies continue to prioritize social issues, even at the expense of profits and shareholders? Our panel answered this with a resounding YES! Michael shared that there is now so much empirical data that the impact of ESG (Environmental, Social, and Governance) initiatives positively affects a company’s financial performance.

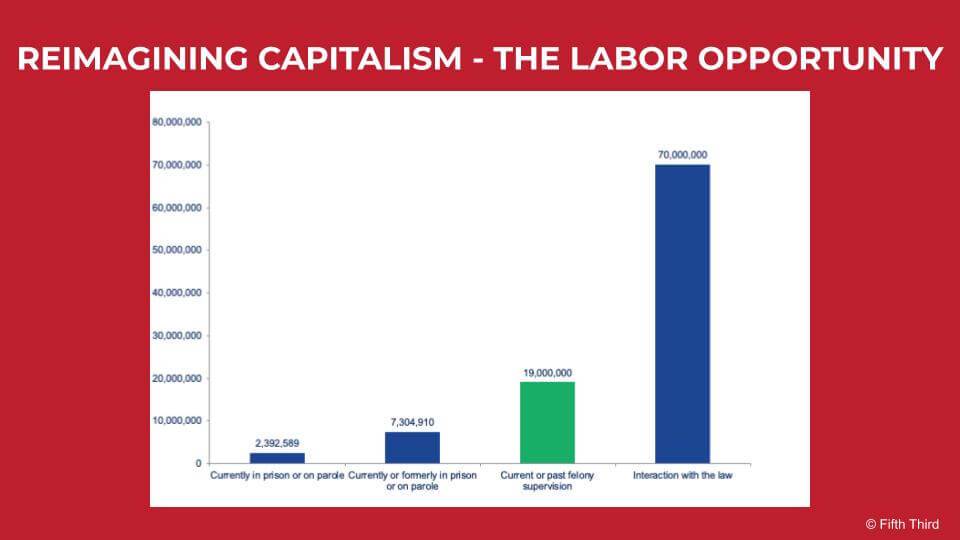

Jeff highlighted labor opportunities if we rethink some of the protocols in our hiring practices that rule out marginalized talent pools but increase an organization’s ability to have more diversity.

Steve championed the idea of rebalancing the distribution of wealth with the consideration of ESOP (Employee Stock Ownership Programs) in succession planning. This wealth distribution can pave a way to bridge the gap between the have’s and have nots. I believe our businesses are being held to higher expectations than ever, but to paraphrase Malcolm Gladwell, it’s clear what got us here won’t get us there. 2021 has so much potential to be the start of change for good.

If You Enjoyed This Article, Check Out These….

Join Thousands Of

Like-Minded Folks

Receive monthly business growth tips

and event invites right to your inbox.